Mistakes to Avoid When Dealing With Digital Payment Processing

Navigating the intricate realm of digital payment processing demands a keen understanding of potential pitfalls to ensure smooth and secure transactions. In this digital age, businesses must be vigilant to avoid common mistakes that can compromise financial integrity and customer trust. Tobacco Payment Processing stands as a preferred way of transaction in an industry that particularly underscores the significance of error-free digital payments. As businesses strive to stay ahead in this rapidly evolving landscape, steering clear of missteps in processing digital payments becomes crucial. Below is a list of blunders to watch out for.

Ignored Security Measures

One of the gravest mistakes a business or individual can make is to overlook security measures when using digital payment systems. It is crucial to pick reliable and reputable payment processors that offer robust security features such as encryption, fraud detection, and multi-factor authentication.

Lack of Payment Options

Limiting payment options can deter potential customers from making a purchase or completing a transaction. Offering a range of payment options enables clients to select the best option for them. By expanding your payment alternatives, you may reach a larger audience and increase consumer satisfaction.

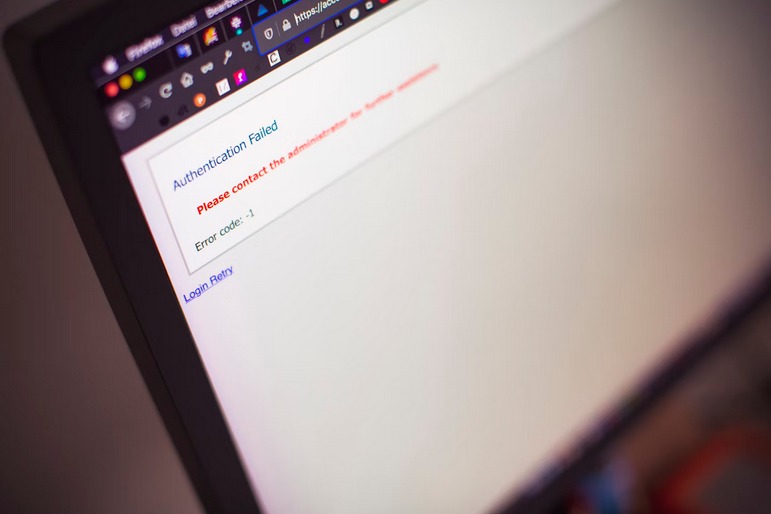

Poor User Experience

A seamless user experience holds a significant role in determining whether customers will return for future transactions. Difficult-to-navigate interfaces, lengthy checkout processes, and confusing error messages can discourage customers from completing purchases. It is essential to invest in user-friendly payment gateways that provide clear instructions, minimal steps, and reliable customer support to minimize friction during the payment process.

Inadequate Payment Process Testing

Failing to test digital payment processes thoroughly can result in significant disruptions and loss of revenue. Before launching a new payment system or making any significant updates, it is crucial to conduct rigorous testing to ensure its compatibility with various devices, browsers, and operating systems. Testing should include scenarios such as failed transactions, refunds, and system downtime to anticipate and troubleshoot any potential issues in advance.

Poor Documentation and Record-Keeping

Accurate record-keeping is vital for financial and legal purposes. Neglecting proper documentation of payment transactions, receipts, and invoices can cause discrepancies and make it challenging to resolve disputes or provide necessary evidence in the future. Implementing an organized system for storing and retrieving financial records will streamline processes and enable smooth audits or investigations if required.

Overlooked Regulatory Compliance

Digital payment processing involves compliance with numerous local and international rules. Failing to stay updated with these regulations can result in severe penalties and reputational damage. It is crucial to invest time and resources in understanding and adhering to applicable regulations to maintain trust and legitimacy in the digital payment landscape.

Avoiding these mistakes when dealing with digital payment processing is essential to ensure a secure, efficient, and reliable financial transaction experience. Embracing best practices will not only foster customer trust but also contribute to long-term growth and success in today’s digital economy.…